personal income tax malaysia 2018

8 tax on gross salesreceipts and other non-operating income in excess of PHP 250000 in lieu of the graduated income tax rates and percentage tax business tax or. Are considered part of a period of consecutive presence if the absence is related to the individuals service in Malaysia personal illness illness of an immediate family member or social visits not.

An application for the tax exemption can be submitted to Talent Corporation Malaysia Berhad from 1 January 2018 to 31 December 2023.

. The SME company means company incorporated in Malaysia with a paid up capital of. List of Countries by Personal Income Tax Rate. Expatriates may benefit from a special tax regime exemption on their income if the following two conditions are verified.

Personal income tax rates. Such as receipts of sale of personal jewelry receipt of sale of some residential property. Treasury both on income tax returns and on FinCEN Form 114.

Personal income tax reduced by 2 percentage points for those earning between RM50k and RM100K. Malaysia 07 Oct 2022. The income tax slabs and rates announced are applicable for the upcoming financial year.

Over 9000 but not over 25000. This is because the correct amount. The income tax slabs for a financial year are announced by the finance minister every year in the Union Budget.

Disposable Personal Income in the United States averaged 596313 USD Billion from 1959 until 2022 reaching an all time high of 2182663 USD Billion in March of 2021 and a record low of 35154 USD Billion in January of 1959. Tax rates on consumption. Income Tax - Know about Govt of Indias Income tax guide rules tax efiling online slabs refund deductions exemptions calculations types of taxes FY 2022-23.

This implies your website will accommodate the screen ratio to fit every device. Water meters should be compulsory and bills should rise says new Environment Agency chairman. Usually the finance minister makes an announcement in the month of February when the budget is announced and once the law is passed by the parliament it becomes.

Multinational tax avoidance strategies see leprechaun economics also known as BEPS actions that Ireland effectively abandoned GDP and GNP statistics as credible measures of its economy and created a replacement statistic called modified gross national income or GNI. There are also differences between tax exemptions tax reliefs tax rebates and tax deductibles so make. A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a maximum of 30 on chargeable.

This means that low-income earners are imposed with a lower tax rate compared to those with a higher income. Comparative information on a range of tax rates and statistics in the OECD member countries and corporate tax statistics and effective tax rates for inclusive framework countries covering personal income tax rates and social security contributions applying to labour income. Issued by the Income Tax Office for purposes of tracking income and income taxes.

Instead of filing Form BE which is filed by individuals under employment or having non-business income sole proprietors file Form B before 30 June on a yearly basis. Malaysias debt liabilities estimated at RM142t up to June. Business income subjected to graduated tax rates shall also be subject to business tax ie.

List of Countries by Personal Income Tax Rate - provides a table with the latest tax rate figures for several countries including actual values forecasts statistics and historical data. Malaysia Sales Tax 2018. Mobirise website builder generates only mobile-friendly sites.

Over 25000 but not over 41500. Income tax filing for sole proprietors is straightforward. First not being defined as a fiscal resident.

PAYE became a Final Withholding Tax on 1st January 2013. The loan is secured on the borrowers property through a process. SST Treatment in Designated Area and Special Area.

Disposable Personal Income in the United States increased to 1866833 USD Billion in August from 1860071 USD Billion in July of 2022. Malaysia Service Tax 2018. Upon receipt and verification including matching current taxpayer and taxpayer representative records with the information on the submitted Form 4506-T a copy of the original.

Weve developed a suite of premium Outlook features for people with advanced email and calendar needs. As a result most employees will not be required to lodge Form S returns. A Microsoft 365 subscription offers an ad-free interface custom domains enhanced security options the full desktop version of Office and 1.

It has gained use as a means of identification for activities like getting a phone connection. In 2017 Irelands economic data became so distorted by US. Malaysia Personal Income Tax Rate.

The graduated tax rates. Malaysia Personal Income Tax Calculator for YA 2020 Malaysia adopts a progressive income tax rate system. Final in the sense that once an employer deducts PAYE from the gross salarywage of a particular employee it represents the final tax liability on that income.

12 VAT or 1 percentage tax as applicable. In such instances tax residents will be exempted from paying personal income tax in Malaysia. It will definitely be a pleasure for your web site audience to get a similarly excellent experience on both.

Dec22 Mauritania 40. Vehicle insurance also known as car insurance motor insurance or auto insurance is insurance for cars trucks motorcycles and other road vehiclesIts primary use is to provide financial protection against physical damage or bodily injury resulting from traffic collisions and against liability that could also arise from incidents in a vehicle. A total of 2437 crore 2437 million PANs have been allotted as of 24 February 2016.

Corporate tax rates and statistics effective tax rates. Vehicle insurance may additionally. The following regular tax rates remain in effect for 2018 and future years.

Ireland is one of the. So far up to August 2018 119 billion Aadhaar Numbers have been issued. For small and medium enterprise SME the first RM600000 Chargeable Income will be tax at 17 and the Chargeable Income above RM600000 will be tax at 24.

A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. Offices or have alliance partners assisting foreign investors in Indonesia India Singapore The Philippines Malaysia. Net taxable income USD Tax.

USD 1120 plus 14 of the excess over USD 25000. Second if the period of employment in Malaysia does not exceed 60 days per. The system is thus based on the taxpayers ability to pay.

Personal income tax deduction for dependents that are children require the following documents to qualify. Charles Santiago says was never told 2018 would be his last poll or that he would be replaced in Klang. The IRS will provide a copy of a gift tax return when Form 4506 Request for Copy of Tax Return is properly completed and submitted with substantiation and payment.

Citizen with foreign bank accounts totaling more than 10000 must declare them to the IRS and the US. An Introduction to Doing Business in Vietnam 2018-19 will provide readers with an overview of the fundamentals. Alan Lovell says households consume too much water and metering is needed to encourage them to cut.

In the process of filing Form B a sole proprietor needs to prepare various information to determine the chargeable. Dec22 Malta 35. Until 31st march 2018Capital gains more than Rs1 Lakh are taxable at 10 15.

7 of the excess over USD 9000.

Corporate Tax Rates Around The World Tax Foundation

How To Calculate Foreigner S Income Tax In China China Admissions

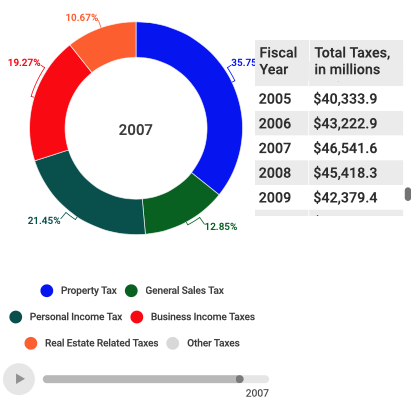

See The Evolution Of Local Tax Revenues In New York City

Thailand Household Income Per Capita 1981 2022 Ceic Data

Are American Taxpayers Paying For Abortion

Taxation In New Zealand Wikipedia

Defense Finance And Accounting Service Civilianemployees Civilian Permanent Change Of Station Pcs Civilian Pcs Entitlement Guide Relocation Income Tax Allowance Rita

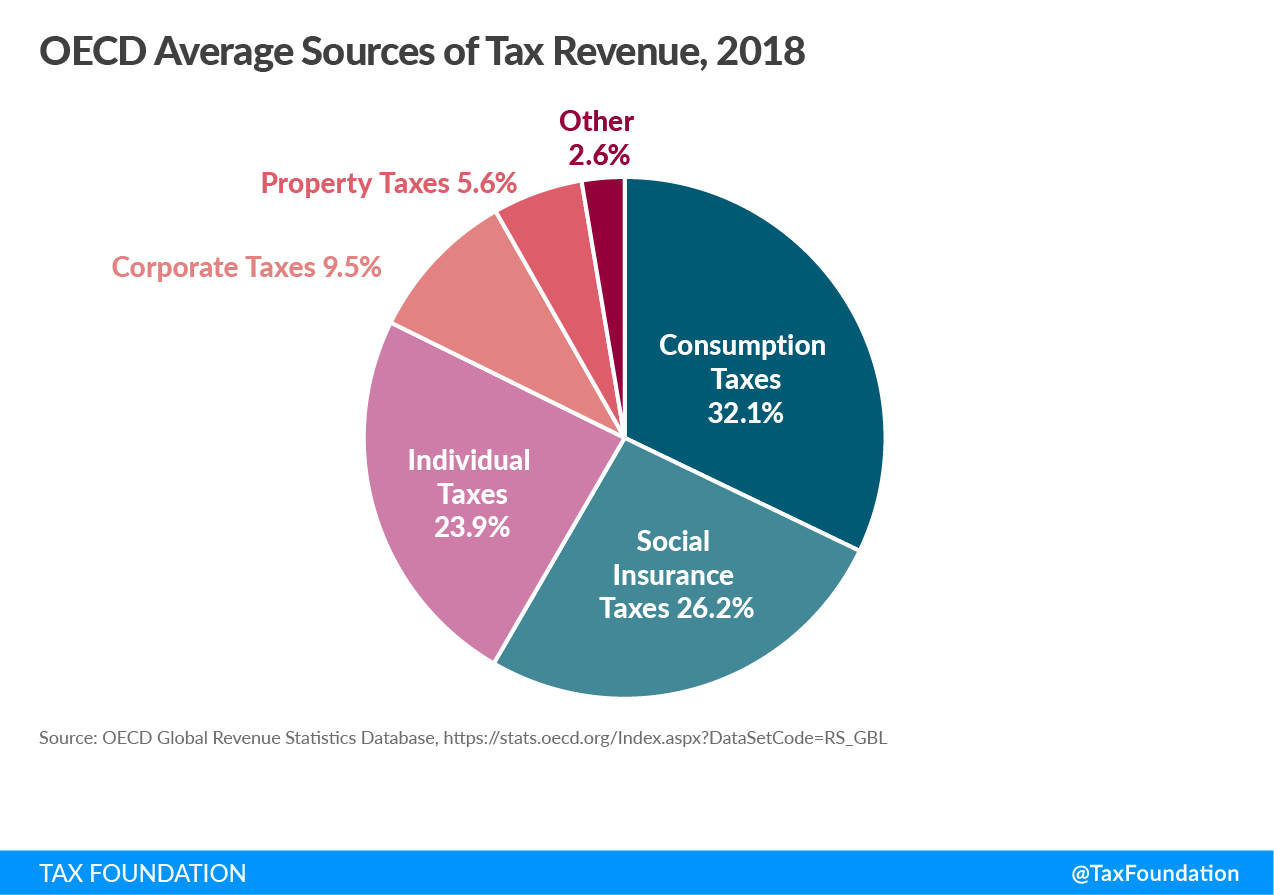

Sources Of Government Revenue In The Oecd Tax Foundation

Facts Statistics Identity Theft And Cybercrime Iii

Panama Taxation Of Cross Border M A Kpmg Global

Malaysian Tax Issues For Expats Activpayroll

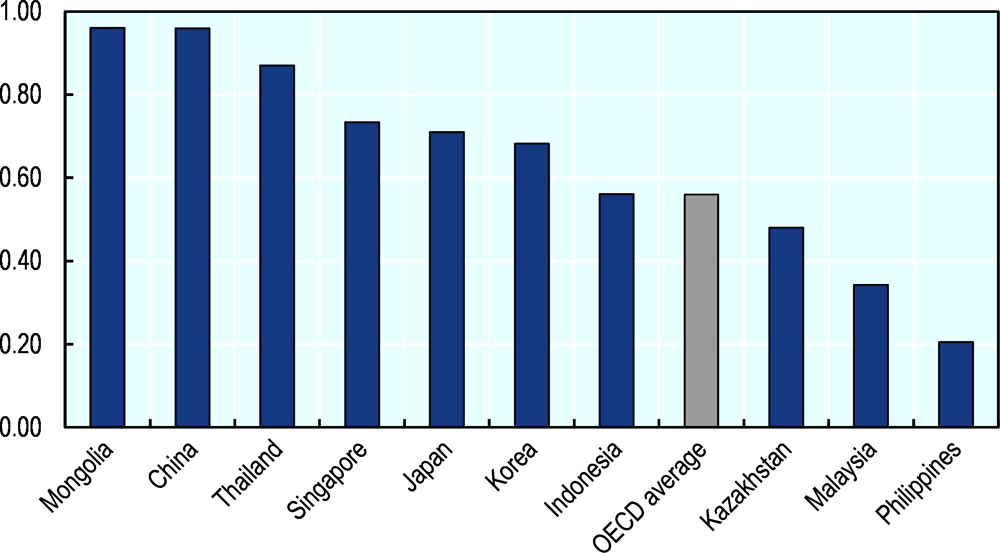

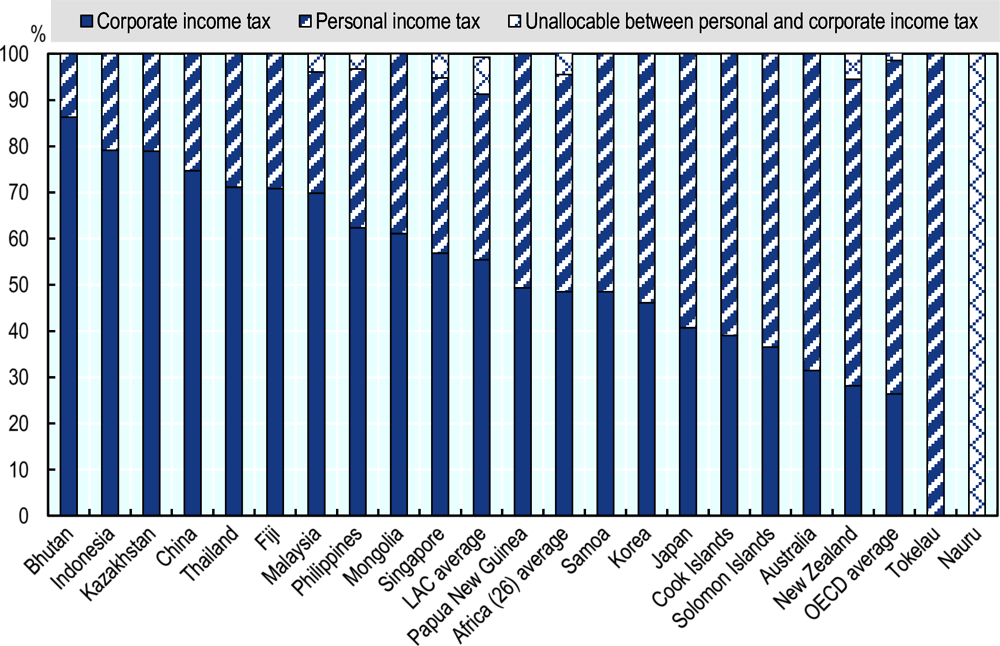

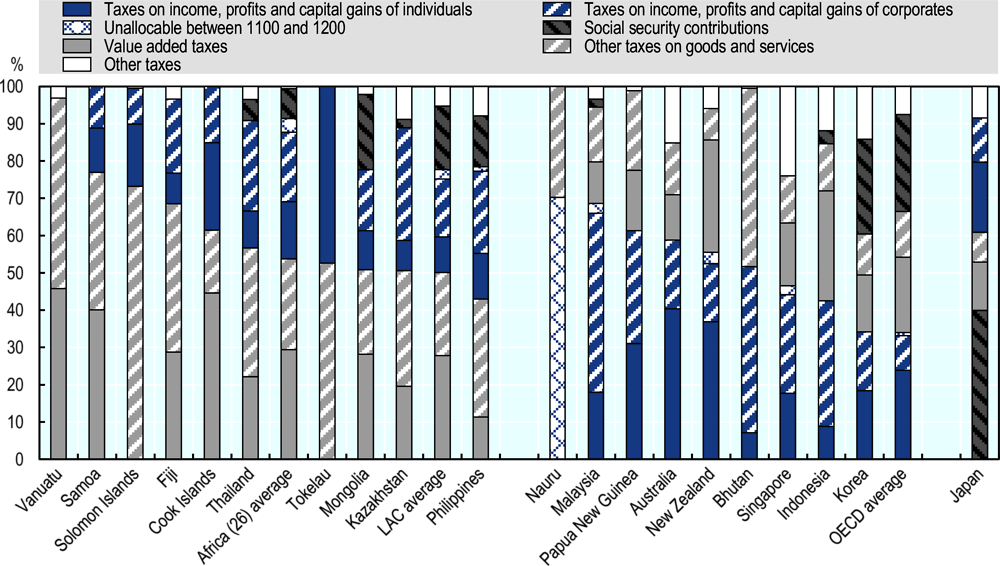

Tax Revenue Trends In Asian And Pacific Economies Revenue Statistics In Asian And Pacific Economies 2020 Oecd Ilibrary

Cover Story Budget 2020 Top Tax Bracket Raised To 30 Tin Number Proposed The Edge Markets

Corporate Tax Rates Around The World Tax Foundation

Tax Revenue Trends In Asian And Pacific Economies Revenue Statistics In Asian And Pacific Economies 2020 Oecd Ilibrary

Income Tax Malaysia 2018 Mypf My

Lebanon Gdp 2022 Data 2023 Forecast 1988 2021 Historical Chart News

Tax Revenue Trends In Asian And Pacific Economies Revenue Statistics In Asian And Pacific Economies 2020 Oecd Ilibrary

Part Ii World Inequality Report 2018

0 Response to "personal income tax malaysia 2018"

Post a Comment